Chairman’s statement

FY25 was a year of strong performance and excellent execution by Harmony’s management.

It also marked our 75th anniversary, a milestone that celebrates our proud legacy as a leading gold miner and our transformation into a globally competitive gold-copper producer.

This was also our 10th consecutive year of meeting production guidance, an objective that is seldom achieved in our sector. This is testament to our operational excellence and world class leadership.

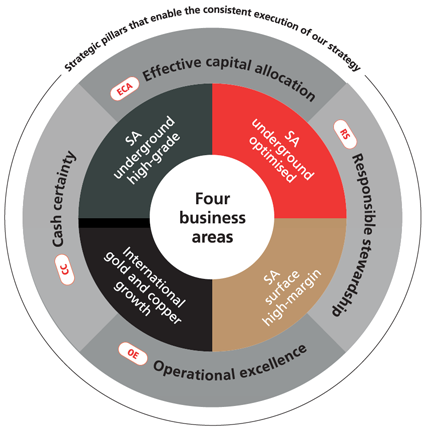

These achievements illustrate the consistency of our performance, and our continued commitment to creating long-term value through operational excellence and effective capital allocation.

Dr Patrice Motsepe

ChairmanChief executive officer’s review

FY25 marked another year of consistent delivery for Harmony. We met our production guidance for the 10th consecutive year, generated record adjusted free cash flows and delivered strong shareholder returns. As we celebrate our 75th anniversary, we remain rooted in gold while evolving into a global, low-cost gold and copper producer.

Copper, a critical enabler of the energy transition, strengthens our portfolio and supports long-term value creation.

Beyers Nel

CEO

Social

Loss of life

11 (FY24: seven)

Group LTIFR*

* Lost-time injury frequency rate.

5.39 (FY24: 5.53)

Millionaire status

(over a million shifts without a loss of life)

for eight of nine underground mines achieved

New silicosis cases among employees(unexposed to mining dust prior to 2025, meeting industry milestone)

Zero(FY24: two)

Female representation in management

23.3% (FY24: 22.0%)

Social investment in host communities projects

(lives impacted through beyond compliance initiatives)

R271 million impacting 33 360 lives

(FY24: R266 million)

Go to our Sustainability report to understand how we manage our sustainability risks and opportunities and how we are progressing towards our sustainability goals.