Projects and exploration

WHY THIS IS MATERIAL to Harmony

Sustaining and growing production is key to our long-term strategy. Our current resources are finite and it is essential to have a project pipeline that balances early-stage and more immediate prospects so as to meet our future targets.

In addition to production, we need to diversify our resource base in order to give us exposure to the counter-cyclical nature of the gold industry.

Relevant material issues: achieving our business objectives

OUR APPROACH

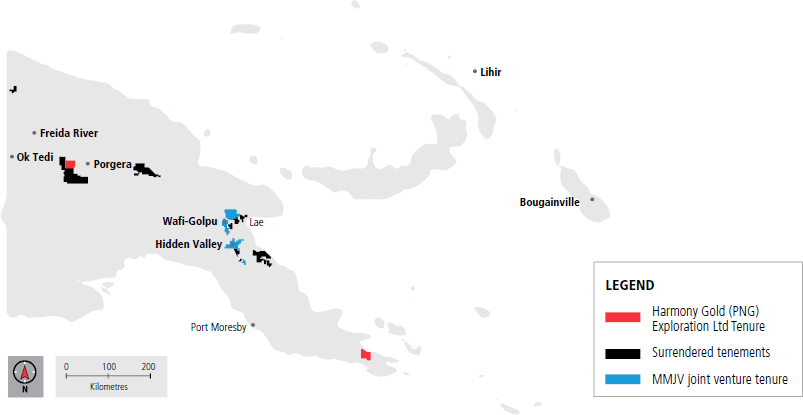

Our exploration programme, like our operations, is focused in South Africa and Papua New Guinea. As we already have knowledge of the local geology, government, infrastructure and regulations, it makes sense to take advantage of this as we expand our pipeline.

Our exploration strategy targets significant prospective geological regions in these countries to discover large long-life gold and copper-gold orebodies that will allow us to create value for years to come. An aim of this strategy is to create a balanced exploration portfolio that includes both brownfields and greenfields exploration. Brownfields exploration allows us to maximise value from existing infrastructure by developing mineral districts that sustain our operations. Greenfields exploration, on the other hand, allows us to create new opportunities in highly prospective under-explored mineral provinces and emerging gold districts.

We take a flexible approach to potential projects that includes looking at joint ventures, acquisitions and other arrangements. However, all projects undergo a robust assessment to determine whether they meet our exploration standards. The criteria include project- and country-related risk profiles, and minimum requirements on the potential size, production profile and investment targets. In addition, we seek out projects that align with our operational imperatives of prioritising safety, maximising in-ground expenditure and drill testing high-priority targets. In this way we can ensure that future projects, once operational, will enable us to meet our long-term strategic objectives.

ACTIONS IN 2014

In FY14, we spent R458 million (US$44 million) (FY13: R673 million, US$76 million) on exploration, both brownfields and greenfields. Of this, 99% was spent in Papua New Guinea, which represents a net reduction of R215 million (US$32 million) (32%) year-on-year. Accordingly, in balancing the need to replace reserves and resource depletion in an environment where profit margin is being eroded by the gold price, the exploration programme has also been restructured. Key principles underpinning the FY14 programme include:

- Reduced exploration spend

- Focus on high-grade near mine (brownfields) opportunities with potential to convert to reserves in the short to medium term

- Rationalisation of the greenfields tenement package

The low gold price environment has also resulted in opening-up of available tenure over highly prospective target areas in Papua New Guinea. In line with our core operating capability in the region, Harmony is monitoring this closely for opportunities that would enhance the project portfolio.

Noteworthy actions

FY14 has seen some significant developments across Harmony’s pipeline of projects in Papua New Guinea. Although there have been some material changes at the grass roots end of the pipeline, in terms of project turnover and prospect development, over 76% of exploration expenditure was at, the Golpu project, directed at development of a low capital execution strategy to turn the project to account.

Prefeasibility study optimisation studies at Golpu:

- Exploration shaft for early underground access and data acquisition

- Refined Golpu geological model based on improved ore body understanding

- Study development of a low cost, high grade start-up mine option

Focus on brownfields exploration:

- Brownfields drilling 13 365m (predominantly Golpu) vs greenfields drilling 2 175m

- Hidden Valley near mine prospect development; new high-grade gold targets discovered between Wau and Edie Creek

Greenfield tenement rationalisation:

- Harmony (100%) tenement holding reduced 73% to 1 125.5km²

- Joint Venture (Harmony 50%) tenement holding reduced 50% to 2 057 km²

Project turnover and development:

- Southern Highlands Province tenement EL2310 pegged. Contains widespread copper-gold porphyry and skarn mineralisation with alteration styles similar to Ok Tedi

- Milne Bay Province tenement ELA2316 pegged. Contains catchment area in excess of 10km² with highly anomalous gold stream sediment anomalism and localised artisanal workings; represents potential new gold province

- Mt Hagen, Amanab, Tari and Lake Kopiago (Hirane) projects closed out and relinquished

EXPLORATIONS PROJECTS

Papua New Guinea

We began actively exploring in Papua New Guinea in 2003. Currently, we have a project portfolio in both established mineral provinces and emerging gold and copper districts covering an area of 3 182km².

The Morobe Mining Joint Ventures or Harmony/Newcrest tenement package is a strategic holding. During FY14 we spent R83 million (US$8 million) on exploration in the area, of which Harmony’s share was 50% of the total. Drill programmes at Garawarria and around the old Wau mine were completed with limited significant intersections. Community permission, which had delayed access to some of the Wau area in recent years, was gained and mapping and soil geochemistry surveys of this area has revealed potential high-grade satellite resources that could supplement the mill-feed at Hidden Valley, approximately 10km to the northeast.

A budget of R68 million (US$6 million) (50% to Harmony) has been allocated for FY15. This year’s primary objective is to discover a new ore body to compliment Hidden Valley operations and the Golpu project. This will be achieved through focused, cost-effective and safe exploration.

- Hidden Valley operations

Brownfields exploration to discover significant new high-grade deposits to replace ore depletion and to displace low grade mill feed for Hidden Valley. Drilling to occur in the Wau area at Upper Namie and 11 Peg. - Golpu area

Drill campaign in H2 for Golpu style deposits. These discoveries will utilise Golpu infrastructure and increase the capital utilisation and efficiency. Continue low cost mapping and sampling areas to generate drill targets for evaluation in coming years. - Greenfields evaluation

Continue to develop geological understanding of the geology and mineralisation of the Morobe Province. Data mining of the voluminous data we already hold.

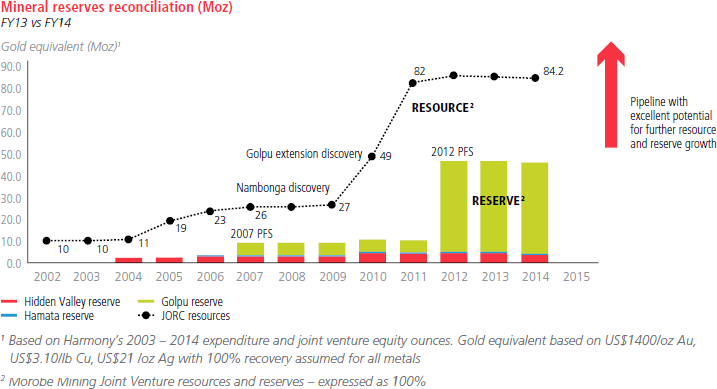

Exploration in Papua New Guinea has been a good investment for Harmony. Since 2003, R2 0612 million (US$253 million) was spent on exploration with attributed resource growth (on a gold equivalent basis) of 32.1Moz over the same period. On this basis, Harmony’s discovery cost in Papua New Guinea stands at R64 (US$7.82) per gold equivalent ounce, which is amongst the best in the world.

Surface exploration of greenstone type gold mineralisation at Kalgold

Exploration at Kalgold has focused on the Windmill target, which has been selected due to its proximity to the mine and encouraging results of previous exploration. A total of 742m have been drilled in the last financial year. Seven boreholes have been completed and all inter Securities and Exchange Commissionted mineralised BIF (Banded Ironstone Formation) units. Drilled boreholes returned an average grade of 2.5g/t but the mineralised zones are narrow (from 0.5m to 11m). The exploration has been curtailed due to financial constraints. No exploration is planned for FY15.

Harmony FY14 Papua New Guinea exploration project locations and work summary

The underlying strategy of this exploration programme and progress during the year are summarised below:

| Project | Target | Progress in FY14 | Targets/plans for FY15 |

|---|---|---|---|

| Wafi-Golpu |

|

|

|

| Hidden Valley district | Brownfields exploration in a 10km radius of the Hidden Valley plant to develop replacement resources and support expansion. |

Exploration target development

work focused on the area

encompassing the historic

gold mining centre at Wau,

approximately 10km to the

northeast of Hidden

Valley.

|

Drill testing high priority targets including Upper Namie, and 11 Peg prospects together with additional prospect development work in line with the district mineralisation model. |

| Regional greenfields exploration | Develop a project pipeline capable of delivering additional quality resources to sustain growth and regional operations. | Garawaria:

|

No major work programmes planned.

|

Harmony Exploration now holds interests in 1 125.5km² of exploration tenure in Papua New Guinea. In all, R63 million (US$6 million) was spent on greenfields exploration in FY14 (FY13: R137 million (US$15 million)) with work focused on two key projects after an economic mineral deposit at Mt Hagen proved unlikely.

| Project | Target | Progress in FY14 | Targets/plans for FY15 |

|---|---|---|---|

| Amanab | Targeting vein stockwork-hosted gold mineralisation. | ||

| Tari | Targeting porphyry copper-gold and associated gold-base metal skarn mineralisation. |

|

Systematic exploration including surface sampling, IP and ground magnetic geophysical surveys, and first pass drill testing is planned for the Kili Teki prospect. The prospect is located in the same belt of rocks that host the Grasberg and Ok Tedi porphyry copper-gold systems and ranks as one of the top underexplored porphyry copper-gold systems in Papua New Guinea. |

| Project Generation | Develop a project pipeline capable of delivering additional quality resources to sustain growth and regional operations. |

|

|

South Africa

| Project | Target | Progress in FY14 | Targets/plans for FY15 |

|---|---|---|---|

| Joel North | Mining down to 137 level. | Most of the infrastructural development on 129 level has been completed and the declines have been advanced almost half way down to 137 level. | Completion of blasting of the decline and the equipping thereof as well as the start of lateral development on 137 level. |

| Central plant reclamation | Reclaim material from FSS5 tailings facility and process it in central plant at 300 000 tpm. Central plant operation will be similar to the highly profitable Phoenix operation, which has been in operation since 2007. | The feasibility study commenced in this financial year and will be completed in Q1 of FY15. | Implementation of the project is planned to start in Q2. |

| Phakisa | Accessing the resource below the bottom of the present mine (75 level) through a twin decline to 85 level. | The feasibility study was completed during the course of the year. | A decision has been made not to proceed with this project. |